Forecast accuracy in turbulent times

Forecast accuracy is one of those measures many finance professionals think and talk about. Turbulent times require companies to produce reliable and solid forecasts. Accuracy is a useful measure that helps finance managers assess the quality of the process (to a certain degree!).

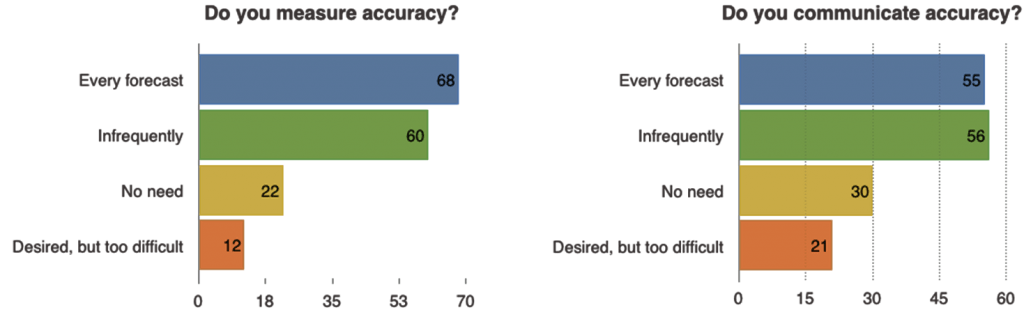

In late 2011, my good colleagues Mark, David and I conducted a survey amongst 160 UK finance professionals. One of the things we wanted to find out was whether accuracy is being measured at all. And guess what – we were pleasantly surprised to see that the majority of all companies do measure and also communicate accuracy. Only a few organizations face difficulties doing so (they utilize spreadsheets as their main tool).

“We stand very little chance of forecasting successfully unless we measure our performance continuously and correct our forecasts accordingly.”, Steve Morlidge & Steve Player, authors of “Future Ready”

Accuracy Insights

About a year ago, I posted a series of articles that focused on forecast accuracy. If you are interested in this topic, I would like to invite you to read and share those entries.

The basics

There is a set of posts that cover the basics of this topic. You can find a bunch of examples in there as well.

- 3 things every controller should know about forecast accuracy

- 4 additional things you should know about forecast accuracy

- 3 ways to analyze and communicate forecast accuracy

- Poor forecast accuracy

- The case for forecast accuracy

Experiences

- A discussion about forecast errors – Interview with Uli Pilsl

- Future Ready? – Interview with Steve Morlidge

If you have any experiences with forecast measurement, please leave a comment. As solid as the above mentioned survey results look, experience shows that many finance professionals are looking for more information about this topic.